Zero interest home improvement loans are financial assistance programs that allow homeowners to upgrade, repair, or renovate their homes without paying interest on the borrowed money. These loans are particularly beneficial for low- to moderate-income families who might struggle to afford essential repairs.

The goal of these loans is to improve living conditions, enhance property safety, and maintain the overall value of homes. They also help homeowners avoid high-interest credit cards or traditional loans, which can lead to financial strain.

Zero-interest loans are often backed by government agencies, local housing departments, or non-profits. They focus on helping communities maintain decent housing while promoting safe, energy-efficient, and comfortable living spaces.

Many homeowners find these loans essential for addressing urgent issues like leaky roofs, faulty electrical systems, or outdated heating. By removing interest costs, these loans make it easier for people to afford necessary home repairs.

How Do Zero interest home improvement loans Work?

Zero interest home improvement loans are simple: you borrow money for specific repairs, and you only repay the amount borrowed—no added interest. This makes them far cheaper than traditional loans or credit cards.

These loans are typically offered for specific purposes, such as safety upgrades, energy-efficient installations, or structural repairs. The loan terms are flexible, with repayment periods ranging from 5 to 20 years, depending on the program and amount borrowed.

- Loan Amount: Often ranges between $5,000 and $25,000, depending on the program.

- Repayment Terms: Equal monthly payments over the loan period with no additional fees.

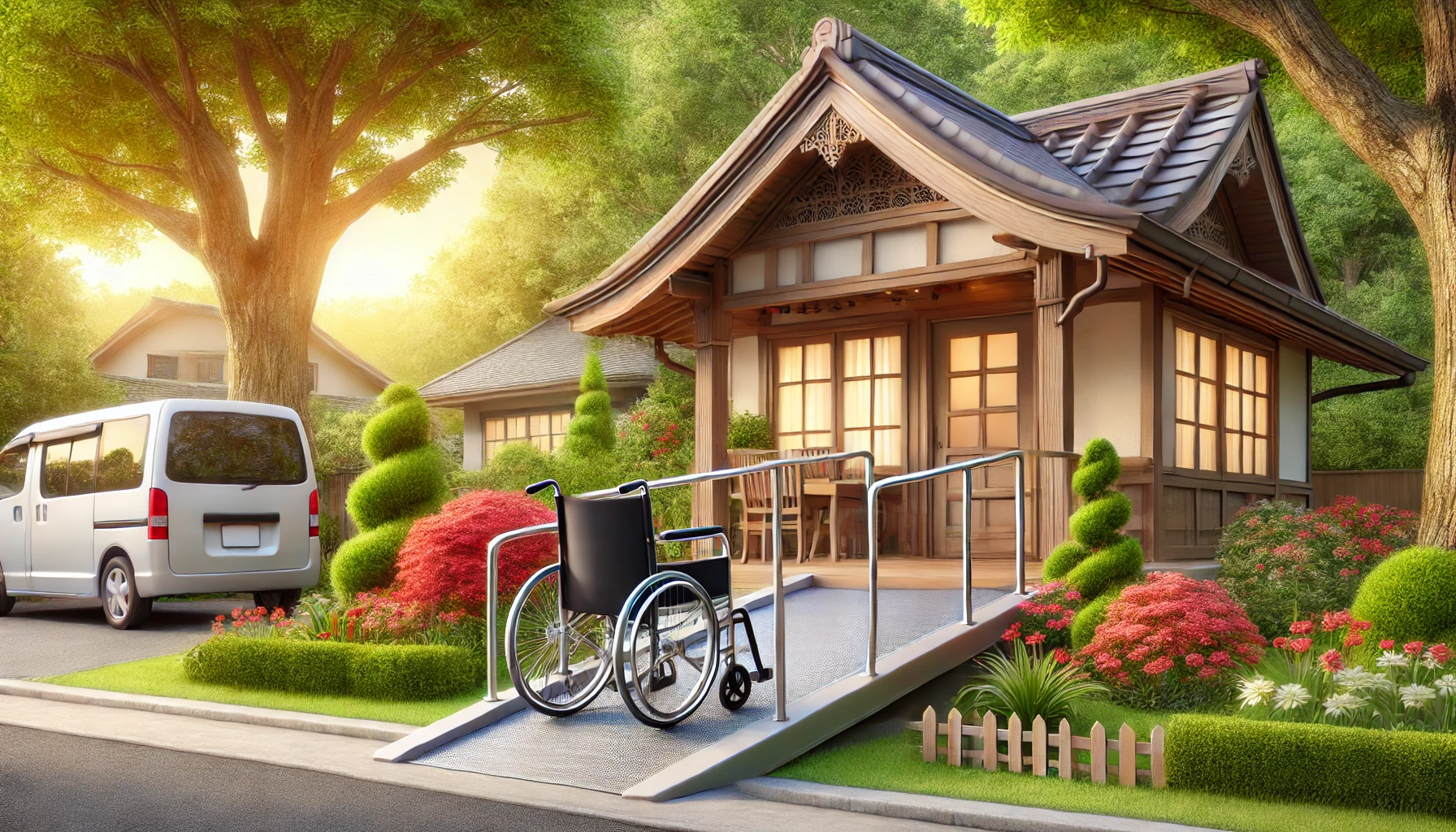

- Eligible Repairs: Roofing, electrical work, plumbing, HVAC upgrades, accessibility features (e.g., ramps), and more.

The funds for these loans often come from government housing programs, local authorities, or community-based organizations. Homeowners must use the funds strictly for the approved improvements. By providing these loans, organizations encourage safe, functional, and energy-efficient housing.

Eligibility Criteria

Not everyone qualifies for zero interest home improvement loans, as they are designed for specific groups of people. These loans often prioritize homeowners who meet income, homeownership, and repair-related requirements.

The most common eligibility criteria include:

- Income Limits: Applicants must fall within a certain income range, often categorized as low-to-moderate income.

- Home Ownership: The applicant must own the home and use it as their primary residence.

- Location-Based Requirements: Some programs only apply to homes in specific neighborhoods, cities, or counties.

In addition, loans often focus on health and safety-related repairs or improvements that add value to the home. For example, fixing a broken roof, upgrading electrical wiring, or installing energy-efficient windows typically qualify.

Before applying, homeowners need to check their local housing programs or organizations for detailed eligibility requirements. The process may also require submitting documents like income proofs, ownership papers, and repair cost estimates.

Benefits of Zero interest home improvement loans

One of the biggest advantages of zero interest home improvement loans is their affordability. By eliminating interest charges, homeowners can focus on repaying only the amount borrowed, reducing overall financial stress.

These loans also make it possible to tackle urgent repairs or upgrades that might otherwise be delayed due to cost. Whether it’s fixing a leaking roof, improving insulation, or upgrading plumbing, these repairs can greatly enhance a home’s safety and comfort.

Additionally, homeowners can benefit from energy-efficient upgrades like better windows, insulation, or HVAC systems. These improvements help lower utility bills and contribute to a greener environment over time.

Another key benefit is the positive impact on property value. Homes that are well-maintained and up-to-date are worth more in the housing market. This can be particularly helpful for homeowners who plan to sell their homes in the future.

Where to Find Zero interest home improvement loans

Finding zero interest home improvement loans requires a bit of research, as they are often offered through specific programs or organizations. The first step is to check for federal, state, or local housing initiatives.

Government housing agencies, such as the U.S. Department of Housing and Urban Development (HUD), often provide funding for such programs. Local city or county housing departments may also offer similar initiatives to revitalize neighborhoods or improve housing quality.

Non-profit organizations like Habitat for Humanity and Rebuilding Together also provide zero-interest loans or grants to qualifying homeowners. These programs often focus on low-income families, seniors, and individuals with disabilities who need critical repairs.

Homeowners can also explore community-based financial institutions, like credit unions or Community Development Financial Institutions (CDFIs). These lenders are known for offering affordable financing solutions tailored to community needs.

Finally, some utility companies provide zero-interest loans for energy-efficient improvements, such as upgrading insulation or installing solar panels. Homeowners should contact local energy providers or housing offices to explore their options.

Steps to Apply for a Zero-Interest Home Improvement Loan

Applying for a zero-interest loan requires careful planning and preparation. The process is straightforward but may vary slightly depending on the program or organization offering the loan.

Research Programs: Begin by searching for federal, state, or local programs offering zero interest home improvement loans. Non-profits and housing agencies are excellent resources as well.

Check Eligibility: Ensure you meet the criteria, such as income limits, ownership status, and location requirements.

Prepare Documents: Gather necessary paperwork, including:

- Proof of income (tax returns, pay stubs).

- Proof of home ownership (deed or title documents).

- Cost estimates for the repairs or upgrades.

Submit an Application: Complete the application form accurately and attach all required documents. Double-check for missing information to avoid delays.

Once the application is submitted, the approval process may take a few weeks. If approved, the funds are released, allowing homeowners to begin their repair or improvement projects.

Conclusion

Zero interest home improvement loans provide homeowners with a practical, affordable way to fund essential repairs and upgrades. By removing interest costs, these loans help families maintain their homes, improve living conditions, and boost property value.

Programs funded by governments, non-profits, and community lenders ensure that eligible homeowners have access to these opportunities. Whether you need to fix a roof, upgrade plumbing, or install energy-efficient systems, zero-interest loans offer a valuable solution.

If you’re a homeowner in need of repairs, exploring these loans could be the key to creating a safer, more comfortable living space. Start by researching local programs and taking the first step toward improving your home!

Article Recommendations

MyFastBroker Loans Brokers: A Comprehensive Guide to Simplified Borrowing

MyFastBroker Insurance Brokers: Your One-Stop Solution for Simplified Insurance

MyFastBroker Trading Platforms: A Complete Guide for Traders

MyWebInsurance.com Auto Insurance: Your Ultimate Guide to Understanding Coverage

MyFastBroker.com Forex Brokers: Your Trusted Guide to Smarter Trading

Myfastbroker Stock Brokers: Your Ultimate Guide to Smarter Investing